top of page

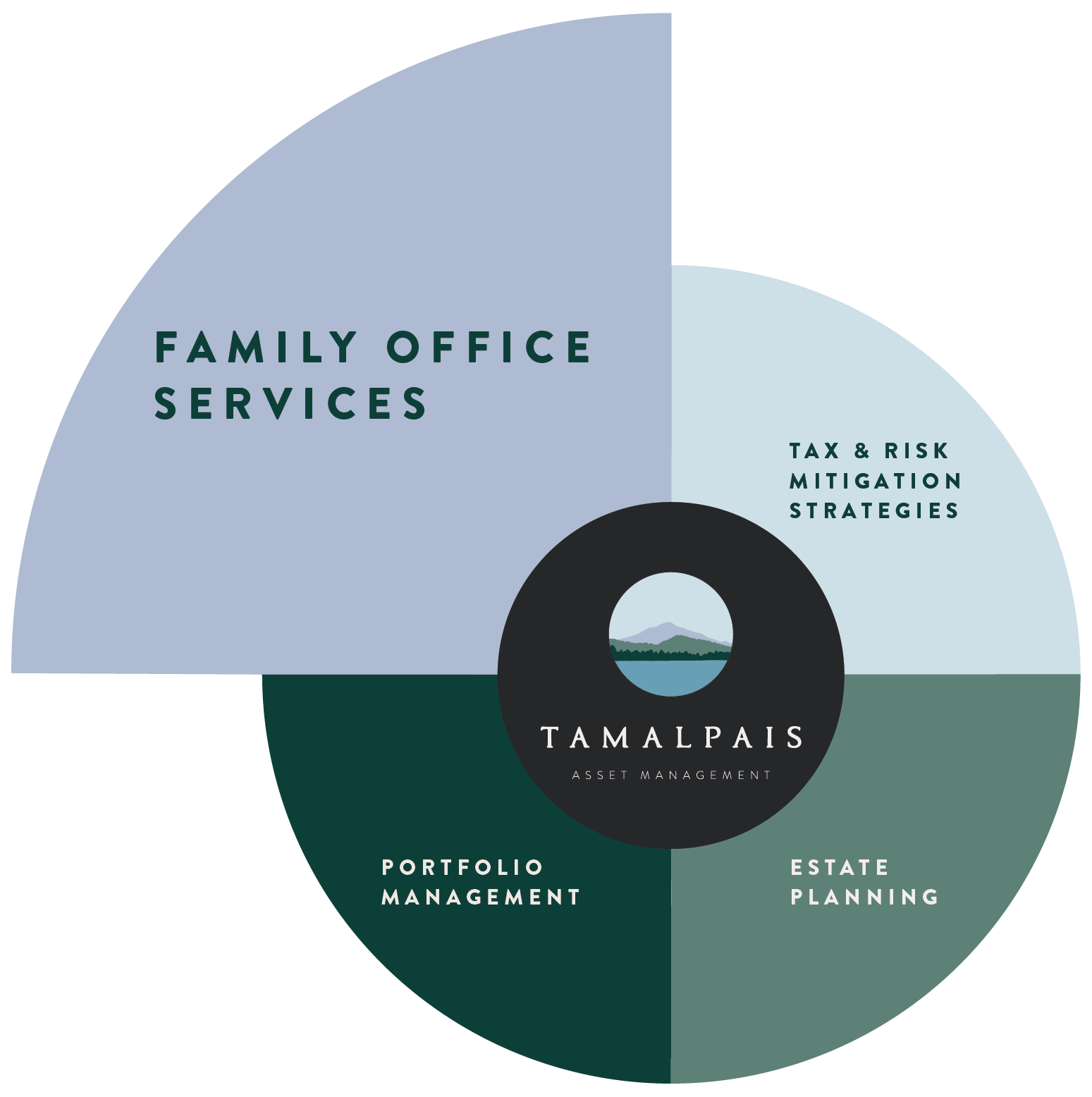

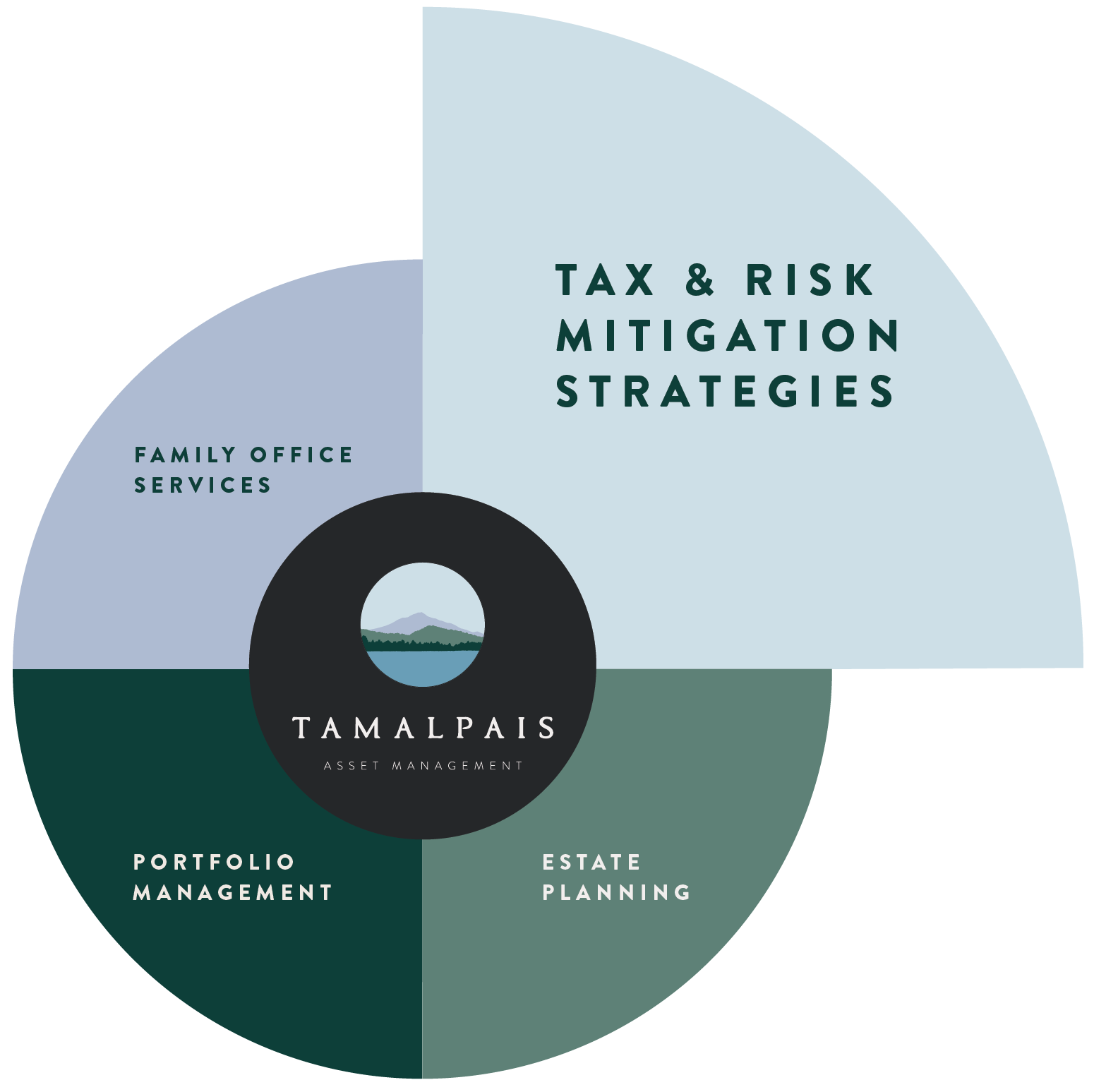

connecting your financial life to your financial goals

We know our clients' financial needs are diverse, complex, and dynamic.

Total wealth management means advising on the full financial picture, where all parts matter to the whole.

Estate Planning

You’ve worked hard to build your wealth. Estate planning is about developing tailored strategies to protect and transfer your wealth efficiently.

-

Collaborating with your family’s legal and tax advisors ensures a cohesive and comprehensive plan that aligns with your overall financial strategy.

-

We work with our clients to develop an estate plan that meets your family’s needs, and then we engage trusted, vetted attorneys to draft the final documents.

Collaborating with your family’s legal and tax advisors ensures a cohesive and comprehensive plan that aligns with your overall financial strategy.

Tax & Risk Mitigation Strategies

We help clients control risk in their financial lives while mitigating tax liabilities where possible.

-

We work throughout the year with you and your tax consultant to understand your complete tax picture and help ensure your liabilities are minimized and your deductions are maximized.

-

We research and consult, providing insight into tax implications of investment decisions on corporate, foundation, estate planning, marital agreement, and other wealth management issues.

In risk mitigation, we work in tandem with top insurance specialists & providers to minimize your risk & protect your assets. We focus on life, health, disability, property & casualty.

family office services

-

We design tailored financial solutions designed to address the unique needs of affluent families, encompassing investment management, tax planning, estate planning, and risk management.

-

We also develop strategies to preserve and grow wealth across generations, including family governance, education, and philanthropy, to leave a lasting impact on future generations.

We help families establish, build, and manage strategies for transferring wealth and protecting/growing it over the long term.

portfolio management

Tam uses defensive, low-volatility portfolios embedded with diversified commercial real-estate deal flow and strategic equity option strategies.

-

We provide bespoke options strategies that supplement and enhance our TAM Core portfolio. We offer crash protection, portfolio overlay, and portfolio hedging.

-

We manage a special-purpose vehicle that invests in proven DualTech Operators–companies creating disruptive technologies for both commercial and government use.

-

In commercial real estate, our investment focus is in middle market transactions, with strategies including value-add acquisitions, opportunistic joint venture developments, and build-to-core transactions

_JPG.jpg)

MAIN OFFICE

© 2024 Tamalpais Asset Management All Rights Reserved

Website designed by Hyde & Union Content

We know our clients' financial needs are diverse, complex, and dynamic.

Gain a comprehensive understanding of your financial situation by aggregating all of your accounts in one place and activating your personalized dashboard. This allows us to create a tailored plan and portfolio, guiding you towards financial freedom.

Total wealth management means advising on the full financial picture, where all parts matter to the whole.

estate planning

You’ve worked hard to build your wealth. Estate planning is about developing tailored strategies to protect and transfer your wealth efficiently.

-

We work with our clients to develop an estate plan that meets your family’s needs, and then we engage trusted, vetted attorneys to draft the final documents.

-

Collaborating with your family’s legal and tax advisors ensures a cohesive and comprehensive plan that aligns with your overall financial strategy.

family office services

We help families establish, build, and manage strategies for transferring wealth and protecting/growing it over the long term.

-

We design tailored financial solutions to address the unique needs of affluent families, encompassing investment management, tax planning, estate planning, and risk management.

-

We also develop strategies to preserve and grow wealth across generations, including family governance, education, and philanthropy, to leave a lasting impact on future generations.

portfolio management

We believe in a personalized approach to wealth management. As an independent Registered Investment Advisor, we prioritize your best interests above all else. We carefully select investments that align with your unique needs, goals, and values, without any bias towards specific products or providers.

-

We expand your investment horizons by providing access to a diverse range of compelling alternative opportunities. We go beyond the ordinary to unlock new possibilities for your portfolio. Our access to diversified and compelling alternative investments opens doors to unique solutions tailored to your needs.

-

In commercial real estate, our investment focus is in middle market transactions, with strategies including value-add acquisitions, opportunistic joint venture developments, and build-to-core transactions.

Learn More About Our Alternative Investment Strategies

-

We provide bespoke options strategies that supplement and enhance our TAM Core portfolio. We offer crash protection, portfolio overlay, and portfolio hedging.

Learn More About Our Option Strategies

tax & risk mitigation strategies

We help clients control risk in their financial lives while mitigating tax liabilities where possible.

-

We work throughout the year with you and your tax consultant to understand your complete tax picture and help ensure your liabilities are minimized and your deductions are maximized.

-

We research and consult, providing insight into tax implications of investment decisions on corporate, foundation, estate planning, marital agreement, and other wealth management issues.

In risk mitigation, we work in tandem with top insurance specialists & providers to minimize your risk & protect your assets. We focus on life, health, disability, property & casualty.

bottom of page